WASHINGTON -- A recent analysis of the 2007 financial markets of 48 countries has revealed that the world's finances are in the hands of just a few mutual funds, banks, and corporations. This is the first clear picture of the global concentration of financial power, and point out the worldwide financial system's vulnerability as it stood on the brink of the current economic crisis.

A pair of physicists at the Swiss Federal Institute of Technology in Zurich did a physics-based analysis of the world economy as it looked in early 2007. Stefano Battiston and James Glattfelder extracted the information [.pdf] from the tangled yarn that links 24,877 stocks and 106,141 shareholding entities in 48 countries, revealing what they called the "backbone" of each country's financial market. These backbones represented the owners of 80 percent of a country's market capital, yet consisted of remarkably few shareholders.

"You start off with these huge national networks that are really big, quite dense," Glattfelder said. “From that you're able to ... unveil the important structure in this original big network. You then realize most of the network isn't at all important."

Then consider that the crisis caused a massive contraction in the number of players still solvent- or with the illusion of solvency- and you begin to appreciate how useful it is to be the drain at the bottom of the whirlpool.

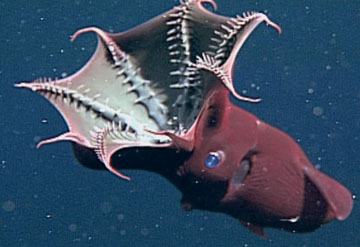

Or the hungriest vampire squid in the deep.

...Based on their analysis, Glattfelder and Battiston identified the ten investment entities who are “big fish” in the most countries. The biggest fish was the Capital Group Companies, with major stakes in 36 of the 48 countries studied. In identifying these major players, the physicists accounted for secondary ownership -- owning stock in companies who then owned stock in another company -- in an attempt to quantify the potential control a given agent might have in a market...

And the main holders in the Capital Group Companies? Why, people like J.P. Morgan Chase, of course.

But on reflection, maybe vampire squid isn't the best analogy for these players.

Bubbles are very useful in gathering the krill.

1 comment:

To me the fact that this was done by physicists is pretty badass.

Post a Comment