Krugman:

...The story has played itself out time and time again over the past 30 years. Global investors, disappointed with the returns they’re getting, search for alternatives. They think they’ve found what they’re looking for in some country or other, and money rushes in.

But eventually it becomes clear that the investment opportunity wasn’t all it seemed to be, and the money rushes out again, with nasty consequences for the former financial favorite. That’s the story of multiple financial crises in Latin America and Asia. And it’s also the story of the U.S. combined housing and credit bubble. These days, we’re playing the role usually assigned to third-world economies...

...The global origins of our current mess were actually laid out by none other than Ben Bernanke, in an influential speech he gave early in 2005, before he was named chairman of the Federal Reserve. Mr. Bernanke asked a good question: “Why is the United States, with the world’s largest economy, borrowing heavily on international capital markets — rather than lending, as would seem more natural?”

His answer was that the main explanation lay not here in America, but abroad. In particular, third world economies, which had been investor favorites for much of the 1990s, were shaken by a series of financial crises beginning in 1997. As a result, they abruptly switched from being destinations for capital to sources of capital, as their governments began accumulating huge precautionary hoards of overseas assets.

The result, said Mr. Bernanke, was a “global saving glut”: lots of money, all dressed up with nowhere to go.

In the end, most of that money went to the United States. Why? Because, said Mr. Bernanke, of the “depth and sophistication of the country’s financial markets.”

All of this was right, except for one thing: U.S. financial markets, it turns out, were characterized less by sophistication than by sophistry, which my dictionary defines as “a deliberately invalid argument displaying ingenuity in reasoning in the hope of deceiving someone.” E.g., “Repackaging dubious loans into collateralized debt obligations creates a lot of perfectly safe, AAA assets that will never go bad.”

In other words, the United States was not, in fact, uniquely well-suited to make use of the world’s surplus funds. It was, instead, a place where large sums could be and were invested very badly. Directly or indirectly, capital flowing into America from global investors ended up financing a housing-and-credit bubble that has now burst, with painful consequences...

That's the print version. On his blog version, it's Stimulus? Never mind.

Paul Krugman thinks Dear Leader won't just sit idly by while Rome burns. He'll pour more gasoline on the flame.

The definition of stimulus differs. For the Ba$e, it means increasing the bottom line. For you, it means a chance to make an honest living.

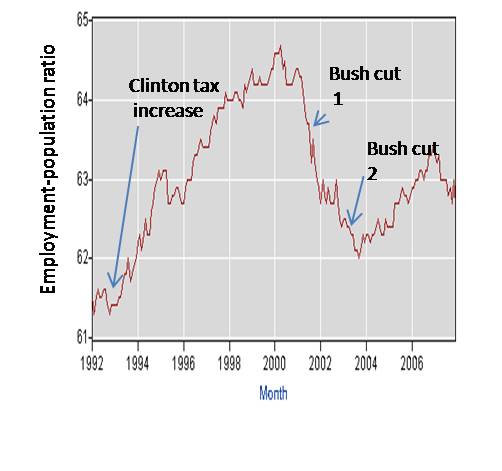

Look how Dear Leader pulled "out" of the 2001 recession: using Greenspan, he encouraged the formation of a financial real estate bubble. The job market never markedly improved, but the corporate bottom line sure did.

Now he thinks about tax breaks for the Big and "rebates" out of your social security fund. But creating real jobs? Don't let's be silly.

Anything that diminishes the Power of the supply-side Force is not something the Ba$e, or its Leader, will allow.

No comments:

Post a Comment