...Aside from business tax breaks — which are an unhappy story for another column — the plan gives each worker making less than $75,000 a $300 check, plus additional amounts to people who make enough to pay substantial sums in income tax. This ensures that the bulk of the money would go to people who are doing O.K. financially — which misses the whole point.

The goal of a stimulus plan should be to support overall spending, so as to avert or limit the depth of a recession. If the money the government lays out doesn’t get spent — if it just gets added to people’s bank accounts or used to pay off debts — the plan will have failed.

And sending checks to people in good financial shape does little or nothing to increase overall spending. People who have good incomes, good credit and secure employment make spending decisions based on their long-term earning power rather than the size of their latest paycheck. Give such people a few hundred extra dollars, and they’ll just put it in the bank.

In fact, that appears to be what mainly happened to the tax rebates affluent Americans received during the last recession in 2001.

On the other hand, money delivered to people who aren’t in good financial shape — who are short on cash and living check to check — does double duty: it alleviates hardship and also pumps up consumer spending...

Why would the administration want to do this? It has nothing to do with economic efficacy: no economic theory or evidence I know of says that upper-middle-class families are more likely to spend rebate checks than the poor and unemployed. Instead, what seems to be happening is that the Bush administration refuses to sign on to anything that it can’t call a “tax cut.”

Behind that refusal, in turn, lies the administration’s commitment to slashing tax rates on the affluent while blocking aid for families in trouble — a commitment that requires maintaining the pretense that government spending is always bad. And the result is a plan that not only fails to deliver help where it’s most needed, but is likely to fail as an economic measure.

The words of Franklin Delano Roosevelt come to mind: “We have always known that heedless self-interest was bad morals; we know now that it is bad economics.”

And the worst of it is that the Democrats, who should have been in a strong position — does this administration have any credibility left on economic policy? — appear to have caved in almost completely.

Yes, they extracted some concessions, increasing rebates for people with low income while reducing giveaways to the affluent. But basically they allowed themselves to be bullied into doing things the Bush administration’s way.

And that could turn out to be a very bad thing.

He goes into detail why here:

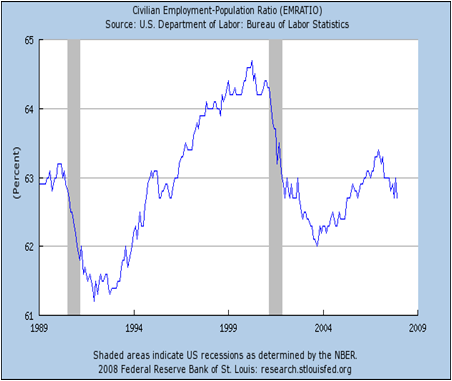

People say that the last recession was brief and mild. But that’s an artifact of the way the NBER defines recessions — basically as periods when everything is going down. Once something starts going up (usually GDP), it’s labeled a recovery. But in the last two recessions the thing that matters most — employment — kept falling long after the official end of the recession.

Did the last two recessions really end quickly?

And in the last two recessions the Fed kept cutting interest rates long after the recessions were supposedly over — all the way down to just 1 percent in 2003:

The Fed didn’t think the recessions were over

Indeed, as Alan Greenspan has revealed, the Fed still feared the possibility of “corrosive deflation” well into 2003.

What finally created a convincing recovery was the housing boom. But that turned into a bubble, which has burst big time.

We don’t know for sure by any means, but it definitely looks possible that this slump will be worse and more persistent than 2001-2003. And housing won’t come to the rescue this time. Meanwhile, the Fed has less room to cut: interest rates can’t go below zero (banks will just sit on cash rather than lend money out at a negative rate), and they started lower this time than they did in 2000.

The bottom line is that Ben Bernanke could definitely use some fiscal wind at his back. But thanks to the lousy deal announced today, he won’t get it.

No comments:

Post a Comment