Of course not:

Tony Hayward cashed in about a third of his holding in the company one month before a well on the Deepwater Horizon rig burst, causing an environmental disaster.

Mr Hayward, whose pay package is £4 million a year, then paid off the mortgage on his family’s mansion in Kent, which is estimated to be valued at more than £1.2 million...

His decision, however, means he avoided losing more than £423,000 when BP’s share price plunged after the oil spill began six weeks ago.

Since he disposed of 223,288 shares on March 17, the company’s share price has fallen by 30 per cent. About £40 billion has been wiped off its total value. The fall has caused pain not just for BP shareholders, but also for millions of company pension funds and small investors who have money held in tracker funds...

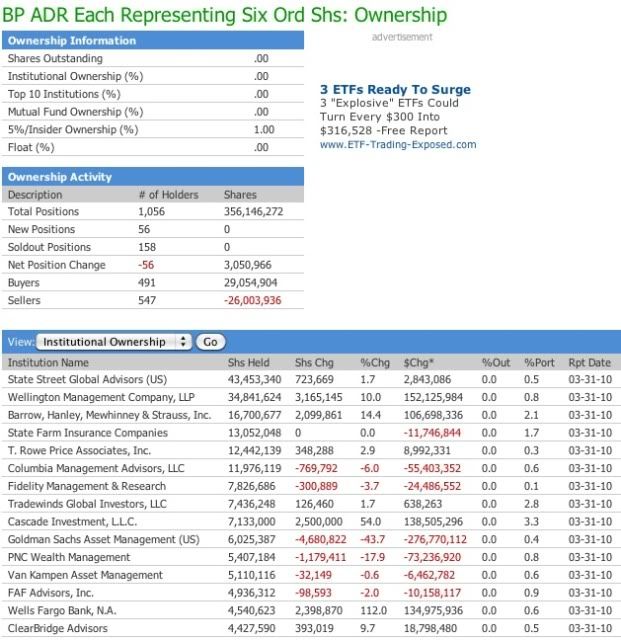

Then there's what the vampire squid and its soulmates did at the end of March, three weeks before the accident:

Then there's this funny business:

Just a week before the Deepwater Horizon exploded, BP PLC asked regulators to approve three successive changes to its oil well over 24 hours, according to federal records reviewed by the Wall Street Journal.

The unusual rapid-fire requests to modify permits reveal that BP was tweaking a crucial aspect of the well's design up until its final days.

One of the design decisions outlined in the revised permits, drilling experts say, may have left the well more vulnerable to the blowout that occurred April 20, killing 11 workers and leaving crude oil gushing into the Gulf of Mexico.

The Minerals Management Service approved all the changes quickly, in one instance within five minutes of submission...

Expeditious, aren't they? [a tip o'teh tinfoil to my anonymous sources]

One more thing is that even if the cap is collecting 10,000 gallons a day- which it likely isn't- the total flow rate may have tripled- meaning that the cap, while allowing BP to make some money, actually made things worse.

But not for those who would rule us, who seem to have baffled the One with bovine fecal extract.

...Obama’s excessive trust in his own heady team is all too often matched by his inherent deference to the smartest guys in the boardroom in the private sector. His default assumption seems to be that his peers are always as well-intentioned as he is. The single biggest mistake he has made in managing the gulf disaster was his failure to challenge BP’s version of events from the start. The company consistently understated the spill’s severity, overestimated the progress of the repair operation and low-balled the environmental damage. Yet the White House’s designated point man in the crisis, Adm. Thad Allen of the Coast Guard, was still publicly reaffirming his trust in the BP chief executive, Tony Hayward, as recently as two weeks ago, more than a month after the rig exploded.

This is baffling, and then some, given BP’s atrocious record prior to this catastrophe. In the last three years, according to the Center for Public Integrity, BP accounted for “97 percent of all flagrant violations found in the refining industry by government safety inspectors” — including 760 citations for “egregious, willful” violations (compared with only eight at the two oil companies that tied for second place). Hayward’s predecessor at BP, ousted in a sex-and-blackmail scandal in 2007, had placed cost-cutting (and ever more obscene profits) over safety, culminating in the BP Texas City refinery explosion that killed 15 and injured 170 in 2005. Last October The Times uncovered documents revealing that BP had still failed to address hundreds of safety hazards at that refinery in the four years after the explosion, prompting the largest fine in the history of the Occupational Safety and Health Administration. (The fine, $87 million, was no doubt regarded as petty cash by a company whose profit reached nearly $17 billion last year.)

No high-powered White House meetings or risk analyses were needed to discern how treacherous it was to trust BP this time. An intern could have figured it out. But the credulous attitude toward BP is no anomaly for the administration. Lloyd Blankfein of Goldman Sachs was praised by the president as a “savvy” businessman two months before the Securities and Exchange Commission sued Goldman. Well before then, there had been a flood of journalistic indicators that Goldman under Blankfein may have gamed the crash and the bailout.

It’s this misplaced trust in elites both outside the White House and within it that seems to prevent Obama from realizing the moment that history has handed to him. Americans are still seething at the bonus-grabbing titans of the bubble and at the public and private institutions that failed to police them. But rather than embrace a unifying vision that could ignite his presidency, Obama shies away from connecting the dots as forcefully and relentlessly as the facts and Americans’ anger demand.

BP’s recklessness is just the latest variation on a story we know by heart. The company’s heedless disregard of risk and lack of safeguards at Deepwater Horizon are all too reminiscent of the failures at Lehman Brothers, Citigroup and A.I.G., where the richly rewarded top executives often didn’t even understand the toxic financial products that would pollute and nearly topple the nation’s economy. BP’s reliance on bought-off politicians and lax, industry-captured regulators at the M.M.S. mirrors Wall Street’s cozy relationship with its indulgent overseers at the S.E.C., Federal Reserve and New York Fed — not to mention Massey Energy’s dependence on somnolent supervision from the Mine Safety and Health Administration.

Given Toyota’s recent game of Russian roulette with Americans’ safety and Anthem Blue Cross’s unconscionable insurance-rate increases in California, Obama shouldn’t have any problem riveting the country’s attention to this sorry saga. He has the field to himself, thanks to a political opposition whose hottest new star, Rand Paul, and most beloved gulf-state governor, Haley Barbour of Mississippi, both leapt to BP’s defense right after the rig exploded. The Wall Street Journal editorial page perfectly set forth the conservative establishment’s party line on May 26: “There is zero evidence so far that this blowout resulted from lax regulation or shoddy practices.” Or as BP’s Hayward asked indignantly, “What the hell did we do to deserve this?”

If Obama is to have a truly transformative presidency, there could be no better catalyst than oil. Standard Oil jump-started Progressive Era trust-busting. Sinclair Oil’s kickback-induced leases of Wyoming’s Teapot Dome oilfields in the 1920s led to the first conviction and imprisonment of a presidential cabinet member (Harding’s interior secretary) for a crime committed while in the cabinet. The Arab oil embargo of the early 1970s and the Exxon Valdez spill of 1989 sped the conservation movement and search for alternative fuels. The Enron scandal prompted accounting reforms and (short-lived) scrutiny of corporate Ponzi schemes.

This all adds up to a Teddy Roosevelt pivot-point for Obama, who shares many of that president’s moral and intellectual convictions. But Obama can’t embrace his inner T.R. as long as he’s too in thrall to the supposed wisdom of the nation’s meritocracy, too willing to settle for incremental pragmatism as a goal, and too inhibited by the fine points of Washington policy debates to embrace bold words and bold action. If he is to wield the big stick of reform against BP and the other powerful interests that have ripped us off, he will have to tell the big story with no holds barred...

Not gonna happen. The big story is decidedly not intended for the rabble. Hell, we can't even learn what happened almost ten years ago, much less this spring.

No comments:

Post a Comment